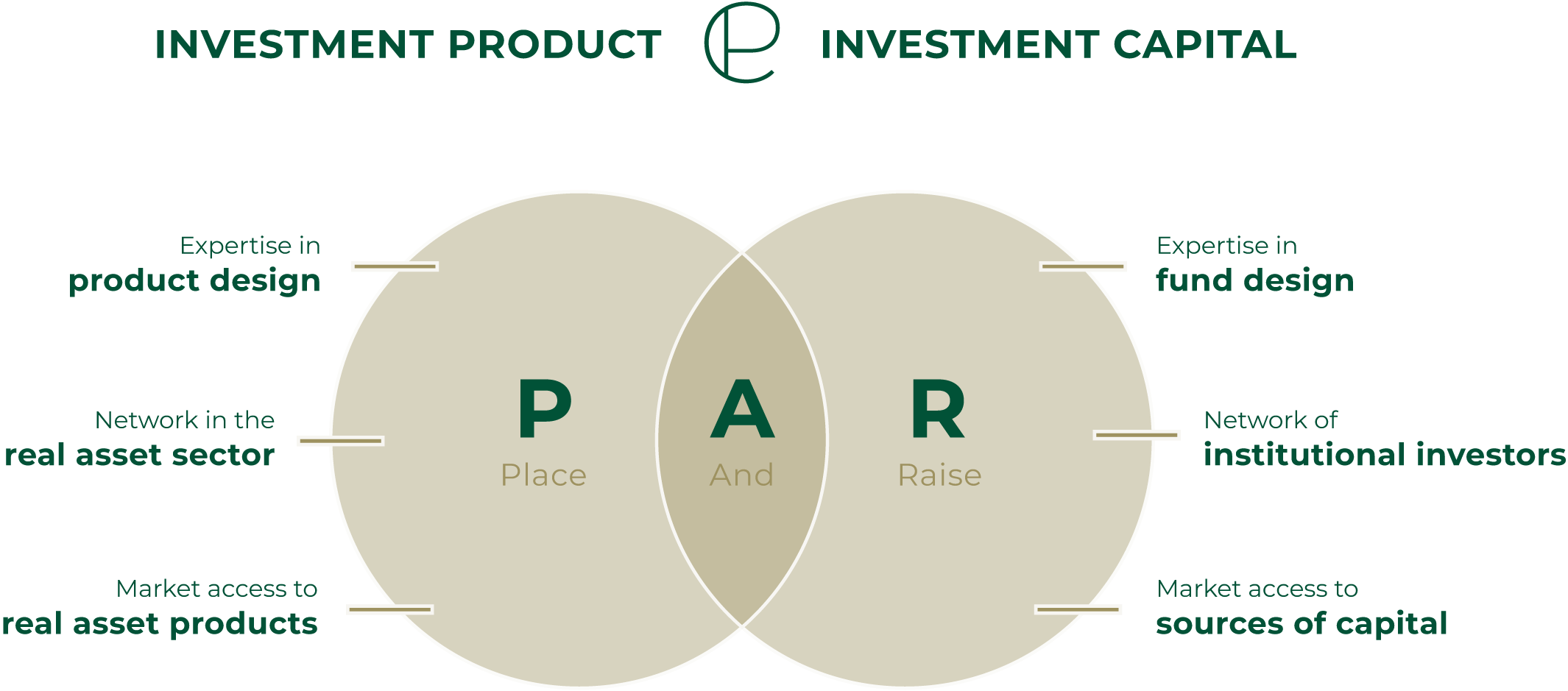

PAR Capital Advisors GmbH is an independent placement agent that advises German and international fund and investment managers as well as real estate developers on designing and structuring real asset investment products for institutional investors, including raising equity. Our management and partners are highly experienced,

and this, in combination with additive network structures, creates a great deal of added value for both managers and investors.

PARCAP is able to support investor approach during all phases of capital raising.

Westend Tower

Grüneburgweg 58-62

60322 Frankfurt

Germany